Bush ‘n Beach has brought Nautilus Marine Insurance on board to expand the fine print and provide readers with clear, easy-to-understand and helpful tips on protecting their boating assets.

Bush ‘n Beach has brought Nautilus Marine Insurance on board to expand the fine print and provide readers with clear, easy-to-understand and helpful tips on protecting their boating assets.

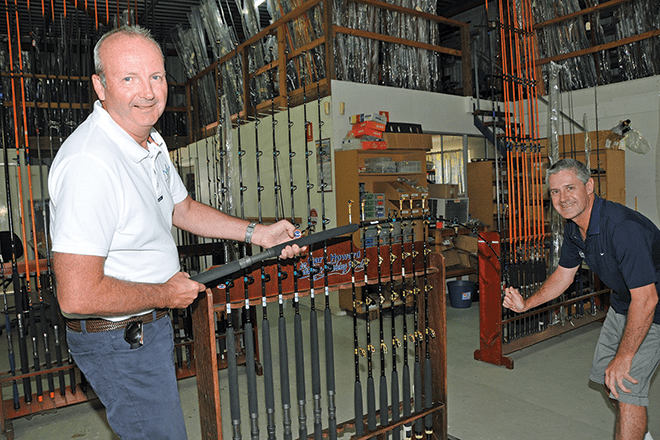

Nautilus Marine will also be answering your boat insurance questions of a general nature and offering a great bi-monthly prize for the best questions received. The prize will be a custom built 15-24kg Nautilus Marine-branded overhead 5’6” light game and reef fishing rod crafted by Gary Howard and featuring Fuji guides, a graphite reel seat and roller tip. Each rod has a retail value of about $300.

Just email your questions to qld@nautilusinsurance.com.au

Who stole my true value?

Here’s a quick quiz that will show you how to cover yourself against one of the most common but most unwelcome surprises relating to boat insurance.

The scenario

You paid $50,000 for your new boat, motor and trailer just over two years ago. You’re a very proud owner and have kept it in immaculate condition. You have had your boat insured for $50,000 since you purchased it. Its new replacement cost today is $55,000.

Someone steals your boat. The insurer says they will pay you $35,000. Which figure do you think you should be paid? $35,000; $50,000 or $55,000? Or some other figure?

The answer

It is quite possible that you will be paid $35,000 – well short of what you now need to go shopping for a replacement boat. However, had you taken the time to review the value of your boat when you renewed your policy, you could have been paid out thousands more – perhaps almost the entire $50,000.

So how did this come about? Some policies state they will pay the full replacement cost of, in this case $55,000, if any total loss is suffered within a certain time frame of purchase or policy inception.

However, after that time frame, they automatically default the sum insured to ‘market value’. Because you have not done anything to confirm the actual market value of your boat, your now stolen boat is given the value of comparable models of comparable age – the market value.

And that means your boat, which you no longer have in your possession to prove just how immaculate it was, will most likely be paid out at market value price. So here’s what to do.

Check your policy thoroughly. If it defaults to market value after a certain time, go to a respected marine dealer, probably the one you bought your new boat from, have the dealer inspect it and appraise its true value and prepare a market valuation form.

Then, when you renew the premium, attach that accurate market valuation form to your policy renewal form and get your insurer to double check the premium. You might be paying a few dollars more because the value of your boat is recognised as being higher, but when it all goes pear-shaped, you can expect to be paid the ‘immaculate condition’ figure that you now have agreed with your insurer, rather than a depreciated market value figure that was based on averaged value.

You can contact Nautilus Marine Insurance on 1300 780 533 for any boat insurance requirements.