The relatively recent storms and massive rainfall events that hit the Queensland coastline before moving further south brought with them graphic lessons on how best to store recreational boats and the need to have proper marine insurance. Gauging rain and storm damage

For a raft of reasons, it makes good sense to try to mitigate the impact of floodwater on your vessel and on your wallet – and in turn, your health. Gauging rain and storm damage

It won’t always be possible but let’s look at a couple of points that may assist you in keeping your boat and assets in times of turmoil.

First, the registered owner of any boat that heads downstream in river or suburban street floodwater and causes damage to other properties or infrastructure, could be held liable for that damage.

Therefore, it is critical to have appropriate marine insurance cover.

That means insurance cover for the boat itself and cover against any damage it may cause.

Unlike a car, where you have a registration fee and compulsory third-party insurance that offers a level of protection, if your vehicle injures someone, your boat registration does not include insurance protection for other people.

It is vital to note that neither boat nor car registration include protection against third-party property damage.

Therefore, if your boat or car causes damage to other things, you could be held liable.

The key distinction here is that the CTP on cars provides a form of injury insurance to other people, but your boat registration does not have this CTP.

There is a rather brutal but wise old adage, “If you can’t afford to insure your boat or car against damage to others, then you can’t afford to own one.”

It was also clear that many vessels stored on trailers were not secured to their trailers and further, that the trailers were not secured to anything else.

If a recreational boat is held to its trailer only by the winch wire, then when water rises, the boat can float off the trailer sideways, causing damage by being perched precariously as the water recedes.

Similarly, in some instances, water can cause the trailer to float off with the boat.

So, the principles that apply when towing on the road and securing the boat to the trailer at a number of points so it won’t jump off if the trailer hits a big bump, apply equally when the trailer is at rest at the side of your home.

Many people create a substantial concrete anchor point in the ground so they can lock or shackle their trailer to it.

Others chain them to a secure post or tree.

Is it a guarantee that your boat will never be stolen or damaged in a flood event? Obviously not, but it might lessen the likelihood of your boat bashing into the side of your house or disappearing down the street.

Open boats left uncovered outside that are not at risk of being ripped away by floodwater should have their bungs removed. That way, the boat won’t fill with water when there are astronomical downpours.

Conversely, boats that potentially could be affected badly by floodwaters may need their bungs kept in, particularly if the boat has an overhead cover that can keep the rain out.

And a tip here on boat covers – get a professionally made cover that has a pocket to allow the interior of the boat to ‘breathe’.

Without adequate ventilation under the cover, some fibreglass boats will ‘sweat’, causing moisture to form under the floor, which can lead to issues with stringer and transom structures.

The transom bungs on many boats are a very short distance above the ground and rising floodwater could cause a boat to sink to the same level as if it had been holed.

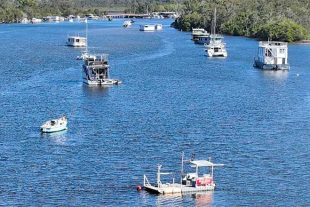

For those with moored boats, the heights of piles securing pontoons need to be considered in the context of the extreme end of the tidal range and potential floodwater flowing past them.

At the end of the day, what is covered and what may not be covered will be interpreted in accord with the terms of insurance as defined in your insurance policy’s product disclosure statement. Similarly, any special conditions and excesses should always be explained clearly in your insurance policy’s PDS.

If you would like further information, contact Nautilus Marine Insurance on 1300 780 533 for any boat insurance requirements.

Visit nautilusinsurance.com.au