THE meaning behind the classic ‘oils ain’t oils’ slogan from television advertisements featuring Sol and his gangster mates also holds true in some respects when it comes to insuring boats.

Not in the context of engine oils or two-stroke and four-stroke technologies, but in terms of boat construction materials and where the vessel’s engine is located.

If you want to pay the lowest possible insurance premium on a powered runabout, then an aluminium or plate alloy boat with an outboard is your go. A fibreglass boat of similar length and market value ordinarily will attract a slightly higher premium.

Now you might argue that this fibreglass boat has an edge over that alloy boat in terms of design and seaworthiness, but ultimately, specialist marine insurers like Nautilus Marine analyse the historical patterns of claims and use that as a consideration in formulating premiums.

Put simply, aluminium and plate alloy boats proportionally figure less prominently in the value of insurance claims lodged than their comparatively sized and/or market-valued fibreglass equivalents. And if the boat is a rigid inflatable, then insuring the hull ordinarily will be towards the higher end of the scale than the alloy and ‘glass boats.

You might argue that RIBs are a very popular design with organisations involved in potentially hazardous applications like rescue, commercial operations or law and security enforcement, and that should not impact on you as a private user.

But again, the premiums are based on the likelihood and historical patterns of claims across all sizes and applications of that material. A small inflatable is perhaps more likely to be blown away in strong wind or more prone to suffering a terminal puncture from a sharp object – decisions are not made arbitrarily.

They are based on extensive experience in analysing claims and wanting to deliver the best option to individual boat owners in order to secure your business. It is these variables which affect the cost of premiums. They are also one of the many reasons why it pays to insure with a specialist marine insurer like Nautilus Marine.

You are dealing with someone who understands boats, the different designs, the different materials, different power sources and different claims histories. You are not dealing with, for example, a specialist in residential housing insurance who simply lumps all boats under one, very high premium category in order to have all the bases covered.

For them, marine insurance may be nothing more than an ‘add-on’ giving a level of convenience to clients who are already signed up to their core line of business – house insurance. Nautilus Marine tailors its policies to the realities of use – and it extends much further than just boat construction materials.

Take engine types and installations for example. If you have two boats of around the same length and value but one has a sterndrive and one has an outboard, which do you think is likely to cost a little more to insure?

If you said the one with the sterndrive, you are correct. Now if you took two similar boats again, one with a marinised inboard, that vessel most probably will attract a slightly higher premium than the sterndrive. Of course, the primary uses of your boat may far outweigh any consideration of a difference in insurance premiums due to its type.

You want that immaculate new fibreglass half cab for your overnight fishing trips and you are not moving from that purchasing position. Fine – at least you know that by dealing with a specialist insurer you will be getting the right insurance for the type of boat you want to buy and how you want to use it.

Bow riders, half cabins, cuddy cabins, centre consoles, side consoles and similar configurations are all regarded as ‘runabouts’ for the purpose of insurance by Nautilus Marine. So while there are variations according to different construction materials and types of propulsion, there is no distinction between deck layouts.

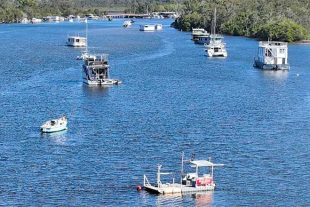

However, and in a related vein, storing a boat on a trailer is proven to have a lower risk factor than having a boat moored on a pontoon. For that reason, there are often additional conditions if the vessel is moored in the water.

There also might be requirements to have an automatically activating bilge pump on the vessel, or for storm covers to be fitted.

So while oils ain’t oils, Sol, remember too that policies ain’t just policies, captain. Special conditions and excesses should always be explained clearly in your insurance policy’s product disclosure document. Always check your PDD and if you have a query, ask for clarification.

If you need further information, you can contact Nautilus Marine Insurance on 1300 780 533 for any boat insurance requirements.

Win a Nautilus Prize Package

Nautilus will also be answering your boat insurance questions of a general nature and will be offering a great bi-monthly prize to the best questions received. The prize is a Nautilus Marine merchandising pack comprising a collapsible chiller bag, a handy marine sports bag and a cap.

Just email your questions to qld@nautilusinsurance.com.au

Bush ‘n Beach Fishing Magazine Location reports & tips for fishing, boating, camping, kayaking, 4WDing in Queensland and Northern NSW

Bush ‘n Beach Fishing Magazine Location reports & tips for fishing, boating, camping, kayaking, 4WDing in Queensland and Northern NSW