If you are one of the fortunate people to have a boat pontoon at the back of your home, make sure you know where you sit in terms of its maritime liabilities.

For example, if your pontoon breaks loose into a river during a storm and tears itself apart as it careers downstream, you will most likely be held liable for any damage it causes.

If it were to smash into a luxury vessel from a neighbouring property, a section of that pontoon could see you presented with a horrendous bill for repairs.

Likewise, if it became wedged under a ferry terminal or a refuelling wharf, making its extraction a dangerous and difficult exercise – read ‘very expensive’.

When on-water and underwater salvage crews turn on the tariff meter to remove what is left of your pontoon so repairs can be undertaken on whatever it damaged, it won’t take long for the extraction bill to read as a phone number with a dollar sign in front of it.

But the financial concerns can be removed beforehand simply by talking to a specialist marine insurer such as Nautilus Marine, who can provide cover for all your maritime assets.

They have policies specifically designed to cover such assets.

These days, with almost everyone having access to a video recording device such as a mobile phone, you can be fairly certain that if your pontoon heads off downstream like a houseboat in a Huckleberry Finn Tom Sawyer novel, someone is going to film its journey.

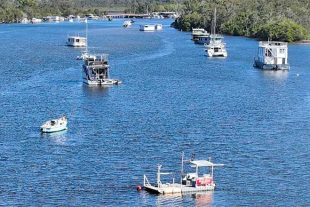

Think back to the Brisbane floods, when nightly television news reports showed pontoons, some with boats perched on them, travelling down the river heading out towards the bay.

Every night they were screened, which in itself provides evidence that such things do happen.

You might think that if your pontoon has no markings on it, then no one will be able to assign the blame to you if it causes damage.

Rest assured that someone somewhere will have an image of your pontoon leaving your home and where it was travelling.

Likewise, a stamped production number will be on it somewhere.

And you wouldn’t need to be a detective to track these indicators back to you as the owner.

In a related vein, according to one insurance source, there was a 6m vessel on a pontoon eddying around the lower reaches of the river in front of the water police. That should have made its identification fairly simple. There are other inherent risks as well.

You could be liable if someone slips on your pontoon and hurts themselves.

Likewise, do you know your legal position if the pontoon causes damage to a revetment wall?

What happens if it is holed by an external force?

Is your pontoon included in your household building insurance?

You want to know the answers to these questions before the legal letters start arriving in your letterbox.

So, for the peace of mind that a good marine insurance policy brings, it’s not worth the gamble that nothing will happen to your pontoon.

Some local government councils are moving towards requiring a valid certificate of insurance for pontoons.

In short, they are seeking to make pontoon owners more accountable for their marine assets.

As always, what is and what may not be covered will always be decided in accord with the terms of insurance, as defined in your insurance policy’s Product Disclosure Statement.

Similarly, any special conditions and excesses should always be explained clearly in your insurance policy’s PDS.

If you need further information, you can contact Nautilus Marine Insurance on 1300 780 533 for any boat insurance requirements. https://www.nautilusinsurance.com.au/